History

History of the GESCO Group

How it started

In 1989, GESCO was founded by a group of committed private investors who recognised the pressing issue of company succession in the SME sector as a key challenge and an attractive investment opportunity. The auditors, tax consultants and entrepreneurs thus initiated GESCO's successful path.

GESCO today

Today, GESCO is one of the most respected investment companies and acts as a holding company for a group of 10 successful SMEs. Since our IPO in 1998, we fulfil the highest transparency standards of the German Stock Exchange and are a reliable partner for our stakeholders.

Important milestones

December 2024

GESCO sells AstroPlast Kunststofftechnik GmbH & Co KG as part of its portfolio optimisation. The transaction was carried out as a management buyout.

January 2024

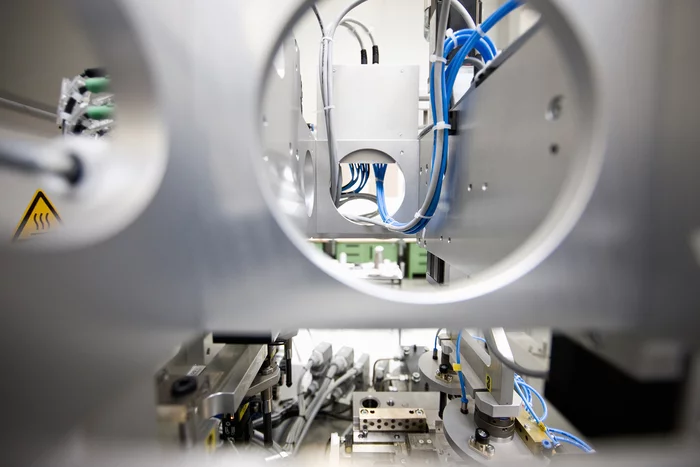

Merger of Hubl GmbH with Sommer & Strassburger GmbH to form Inex-solutions GmbH with excellent stainless steel solutions for a wide range of products in the Healthcare, Semiconductor, Food & Beverage and Energy & Environmental sectors.

January 2023

The transfer from GESCO AG to GESCO SE has been officially completed. This transformation into a European legal form signals our ambition as a forward-looking and internationally oriented industrial group in the SME sector.

September 2022

Merger of W. Krömker GmbH and Haseke GmbH to form AMTRION GmbH as an innovation leader for high-quality medical technology products and support arms and holding systems of all kinds.

June 2021

Acquisition of W. Krömker GmbH - European market leader for articulated arm systems and pioneer in medical technology.

December 2020

The sale of the Mobility Technology segment closed an important chapter in the history of GESCO.

End of 2018/beginning of 2019

The introduction of the "NEXT LEVEL" strategy marks the start of a new phase for GESCO and its subsidiaries.

2018

With the acquisition of Sommer & Strassburger, a specialist for process technology in the pharmaceutical, food and chemical industries, we are expanding our expertise and our market position.

2017

The capital increase, which was several times oversubscribed, generates fresh capital totalling almost 20 million euros.

2016/2017

Acquisition of the Pickhardt & Gerlach Group, a leading refiner of strip steel, as part of a succession plan.

2016

Share split at a ratio of 1:3 to facilitate the tradability of our shares and increase liquidity on the capital market.

2014

25 years of GESCO - a reason to celebrate!

2012

GESCO successfully places another capital increase and realises issue proceeds of € 19.3 million.

2007

Second capital increase after the IPO: 10% increase in share capital with issue proceeds of 9.8 million euros.

2005

Placement of a capital increase increased the share capital by 10 % and generated issue proceeds of EUR 6.8 million.

1998

24 March 1998: Successful IPO on the Frankfurt Stock Exchange

1989

GESCO was founded